TSX Venture Exchange: CNCO

NEWS RELEASE

ARIZONA COPPER AND GOLD LTD. AND CORE NICKEL CORP. PROVIDE UPDATE ON REVERSE TAKEOVER TRANSACTION AND CONCURRENT FINANCING

Not for distribution to U.S. news wire services or for dissemination in the United States.

Toronto, Ontario – November 24, 2025 – Arizona Copper and Gold Ltd. (the “Company” or “ACG”) and Core Nickel Corp. (TSXV: CNCO) (“Core Nickel”, and together with ACG, the “parties”) are pleased to provide an update to their previously announced concurrent brokered private placements and proposed business combination pursuant to which Core Nickel will acquire all of the issued and outstanding securities of ACG resulting in a reverse takeover of Core Nickel by ACG’s shareholders (the “Proposed Transaction”).

The Concurrent Financing

The parties are pleased to announce that the concurrent brokered private placements of Core Nickel (the “Core Nickel Offering”) and ACG (the “ACG Offering” and, together, the “Concurrent Offerings”), previously disclosed in press releases dated October 2, 2025 and October 20, 2025, are scheduled to close on November 25, 2025 (the “Closing Date”). The parties expect to issue an aggregate of 2,659,542 subscription receipts of ACG (the “ACG Subscription Receipts”) and Core Nickel (the “Core Nickel Subscription Receipts” and, together with the ACG Subscription Receipts, the “Subscription Receipts”) at a price of $1.20 per Subscription Receipt (which, for greater certainty, is on a post-Consolidation (as defined below) basis in respect of the Core Nickel Subscription Receipts), for aggregate gross proceeds of $3,191,450 from the Concurrent Offerings.

Stifel Canada and Clarus Securities Inc. (together, the “Co-Lead Agents”) are acting as co-lead agents and joint bookrunners on behalf of a syndicate of agents which includes PowerOne Capital Markets Limited, on a “best efforts” basis in connection with the Concurrent Offerings.

Each ACG Subscription Receipt will be deemed to be automatically converted, without payment of additional consideration or further action by the holder thereof, into one unit in the capital of ACG (each, an “ACG Unit”), subject to adjustment in certain events, immediately before the closing of the Proposed Transaction, upon the satisfaction and/or waiver of certain escrow release conditions (as will be set out in the ACG Subscription Receipt Agreement (as defined below)) at or before the date that is 120 days from the Closing Date (the “Escrow Release Deadline”). Each ACG Unit shall consist of one common share (an “ACG Share”) in the capital of ACG and one ACG Share purchase warrant (an “ACG Warrant”). It is expected that immediately after conversion of the ACG Subscription Receipts into ACG Shares and ACG Warrants, and upon completion of the Proposed Transaction, for no additional consideration and without any further action by the holders thereof: (i) each ACG Share shall be exchanged for one post-Consolidation common share (a “Resulting Issuer Share”) of Core Nickel, as it will exist after the completion of the Proposed Transaction (the “Resulting Issuer”), and (ii) each ACG Warrant shall be immediately exchanged for one post-Consolidation warrant of the Resulting Issuer (a “Resulting Issuer Warrant”). Each Resulting Issuer Warrant will be exercisable for one Resulting Issuer Share for a period of three years from the Closing Date at an exercise price of $1.50 per Resulting Issuer Share.

Each Core Nickel Subscription Receipt will be deemed to be automatically converted, without payment of additional consideration or further action by the holder thereof, into one unit in the capital of Core Nickel (each, a “Core Nickel Unit”), subject to adjustment in certain events, immediately before the closing of the

News Release November 24, 2025

Proposed Transaction, upon the satisfaction and/or waiver of certain escrow release conditions (as will be set out in the Core Nickel Subscription Receipt Agreement (as defined below)) at or before the Escrow Release Deadline. Each Core Nickel Unit shall consist of one post-Consolidation Resulting Issuer Share and one post-Consolidation Resulting Issuer Warrant. The Core Nickel Subscription Receipts are being issued on a post-Consolidation basis at a post-Consolidation price of $1.20 per Core Nickel Subscription Receipt (or $0.14 per subscription receipt if calculated on a pre-Consolidation basis).

In consideration for their services in connection with the Concurrent Offerings, the parties have agreed to pay the Agents a cash fee (the “Agents’ Fee”) of up to 6.0% of the gross proceeds from the sale of the Subscription Receipts, of which 50% of the Agents’ Fee will be paid on the Closing Date and the remaining 50% of the Agents’ Fee will be deposited in escrow and released to the Agents in connection with the conversion of the Subscription Receipts. As additional consideration for the services of the Agents, the Agents will be granted broker warrants of the Resulting Issuer (the “Broker Warrants”) in such number as is equal to up to 6.0% of the number of Subscription Receipts sold in the Concurrent Offerings. Each Broker Warrant shall be exercisable to acquire one Resulting Issuer Share at a price of $1.20 for a period of 12

months following the escrow release and conversion of the Subscription Receipts. The Broker Warrants shall be issued to the Agents upon release of the escrowed funds and conversion of the Subscription Receipts.

The Core Nickel Subscription Receipts will be created and issued pursuant to a subscription receipt agreement (the “Core Nickel Subscription Receipt Agreement”) to be dated as of the Closing Date, among Core Nickel, the Co-Lead Agents and Olympia Trust Company (the “Subscription Receipt Agent”), appointed as subscription receipt agent for the Core Nickel Subscription Receipts pursuant to the terms of the Core Nickel Subscription Receipt Agreement. The ACG Subscription Receipts will be created and issued pursuant to a subscription receipt agreement (the “ACG Subscription Receipt Agreement”, and together with the Core Nickel Subscription Receipt Agreement, the “Subscription Receipt Agreements”) to be dated as of the Closing Date, among ACG, the Co-Lead Agents and the Subscription Receipt Agent, appointed as subscription receipt agent for the ACG Subscription Receipts pursuant to the terms of the ACG Subscription Receipt Agreement.

The net proceeds of the Concurrent Offerings are expected to be used by the Resulting Issuer to fund exploration activity at its Eagle Project as well as for working capital and general corporate purposes.

All other details of the Concurrent Offerings are included in the press releases of ACG and Core Nickel dated October 2, 2025 and October 20, 2025.

Proposed Transaction Summary

Further to the parties joint press release of September 16, 2025, it is intended that ACG and Core Nickel will complete the Proposed Transaction by way of a court approved plan of arrangement (the “Arrangement’) under Section 182 of the Business Corporations Act (Ontario) on terms and conditions to be set out in the definitive arrangement agreement to be entered into between the parties (the “Definitive Agreement”).

Under the Proposed Transaction, the holders of ACG Shares, including those ACG Shares acquired in the ACG Offering, will receive Resulting Issuer Shares in exchange for their ACG Shares upon completion of the Arrangement. In addition, upon the completion of the Arrangement, all of ACG’s securities exercisable or exchangeable for, or convertible into, or other rights to acquire ACG securities outstanding at completion of the Proposed Transaction, including all outstanding stock options of ACG (the “ACG Options”) and ACG Warrants (collectively, with the ACG Options and ACG Shares, the “ACG Securities”) will be replaced with or exchanged for securities exercisable or exchangeable for, or convertible into, rights to acquire Resulting Issuer Shares, on the same economic terms and conditions as such original outstanding securities.

In connection with the Proposed Transaction, Core Nickel will consolidate its shares on an 8.5 to 1 basis immediately prior to the closing of the Proposed Transaction (the “Consolidation”). Following completion of the Consolidation, the outstanding ACG Securities will be exchanged for equivalent securities of the Resulting Issuer on a 1 for 1 basis (the “Exchange Ratio”) pursuant to the Arrangement reflecting a deemed price (on a post-Consolidation basis) of $1.20 per Core Nickel Share for each ACG Share. Based on the

News Release November 24, 2025

foregoing, the aggregate deemed price for the ACG Shares is expected to be approximately $47,842,740 (not including the Concurrent Offerings).

The Proposed Transaction will result in the “reverse takeover” (as defined in TSX Venture Exchange (“TSXV”) Policy 5.2) of Core Nickel by ACG shareholders.

The business of the Resulting Issuer will be primarily focused on the exploration and development of ACG’s Eagle Project in Yavapai County, Arizona. While the Resulting Issuer’s focus will be on exploration and development of the Eagle Project, it will continue to own Core Nickel’s land portfolio in the Thompson Nickel Belt of northern Manitoba, including the Mel deposit. It is expected that the Resulting Issuer will be classified as a Tier 2 Mining Issuer.

Name Change

It is the parties’ intention that the Resulting Issuer Shares will be listed on the TSXV following the closing of the Proposed Transaction. Core Nickel intends to change its name to “Arizona Eagle Mining Corp.”, or such other name designated by ACG and that is acceptable to the regulatory authorities (the “Name Change”).

Continuance

Core Nickel shall also seek regulatory and shareholder approval to continue out of the Business Corporations Act (British Columbia) and into the jurisdiction of Ontario, under the Business Corporations Act (Ontario).

Closing Conditions

Completion of the Proposed Transaction is subject to a number of conditions, including, but not limited to, the parties entering into the Definitive Agreement, the receipt of required regulatory approvals, including the approval of the TSXV, completion of the Concurrent Offerings, the receipt of the requisite Core Nickel shareholder approval for the Proposed Transaction, the Consolidation, the Name Change, the Continuance

and the election of directors of the Resulting Issuer, the receipt of the requisite approval of ACG shareholders for the Proposed Transaction, court approval of the Arrangement, and certain standard closing conditions, including there being no material adverse change in the business of ACG or Core Nickel prior to completion of the Proposed Transaction.

Capitalization of the Resulting Issuer

Pre-Closing Capitalization of Core Nickel

As of the date hereof, Core Nickel has 54,991,718 common shares (“Core Shares”) issued and outstanding, 18,820,891 common share purchase warrants (“Core Warrants”) outstanding and 3,490,000 incentive stock options (“Core Options”) outstanding. The Core Shares are currently listed on the TSXV under the symbol “CNCO”.

Prior to closing of the Proposed Transaction, and subject to Core Nickel shareholder approval, it is intended that Core will undertake the Consolidation on the basis of 1 post-consolidation Core Share for every 8.5 pre-consolidation Core Shares.

Pre-Closing Capitalization of the Company

As of the date hereof, ACG has 39,868,950 ACG Shares issued and outstanding and 2,500,000 ACG Options outstanding. The ACG Shares and ACG Options issued and outstanding at the closing time of the Proposed Transaction will be exchanged for Resulting Issuer Shares and Resulting Issuer Options at the Exchange Ratio.

Concurrent Financings.

News Release November 24, 2025

It is anticipated that the parties will issue 2,659,542 Subscription Receipts in the Concurrent Offerings, which will result in the issuance of an aggregate of a 2,659,542 Resulting Issuer Shares and 2,659,542 Resulting Issuer Warrants pursuant to the Proposed Transaction.

Capitalization of the Resulting Issuer

Without giving effect to the closing of the Concurrent Offerings as described above, upon completion of the Proposed Transaction (and on a post-Consolidation basis), the current shareholders of ACG will own 39,868,950 Resulting Issuer Shares, representing approximately 86% of the Resulting Issuer Shares and the current shareholders of Core Nickel will own 6,469,614 Resulting Issuer Shares representing approximately 14% of the outstanding Resulting Issuer Shares.

Trading

Trading in the Core Shares is currently halted in accordance with TSXV policies, and will remain halted until completion of the Proposed Transaction. Core intends to apply to the TSXV for reinstatement of trading of the Resulting Issuer Shares when permitted pursuant to TSXV policies.

About Core Nickel

Core Nickel is a junior nickel exploration company that controls 100% of five projects in the Thompson Nickel Belt, a prolific nickel district located in Northern Manitoba, Canada. Core Nickel has been focused on the discovery of economic magmatic nickel-sulphide deposits. The Mel deposit, is situated just 25 kilometers northwest of the Thompson Mill.

About ACG and the Eagle Project

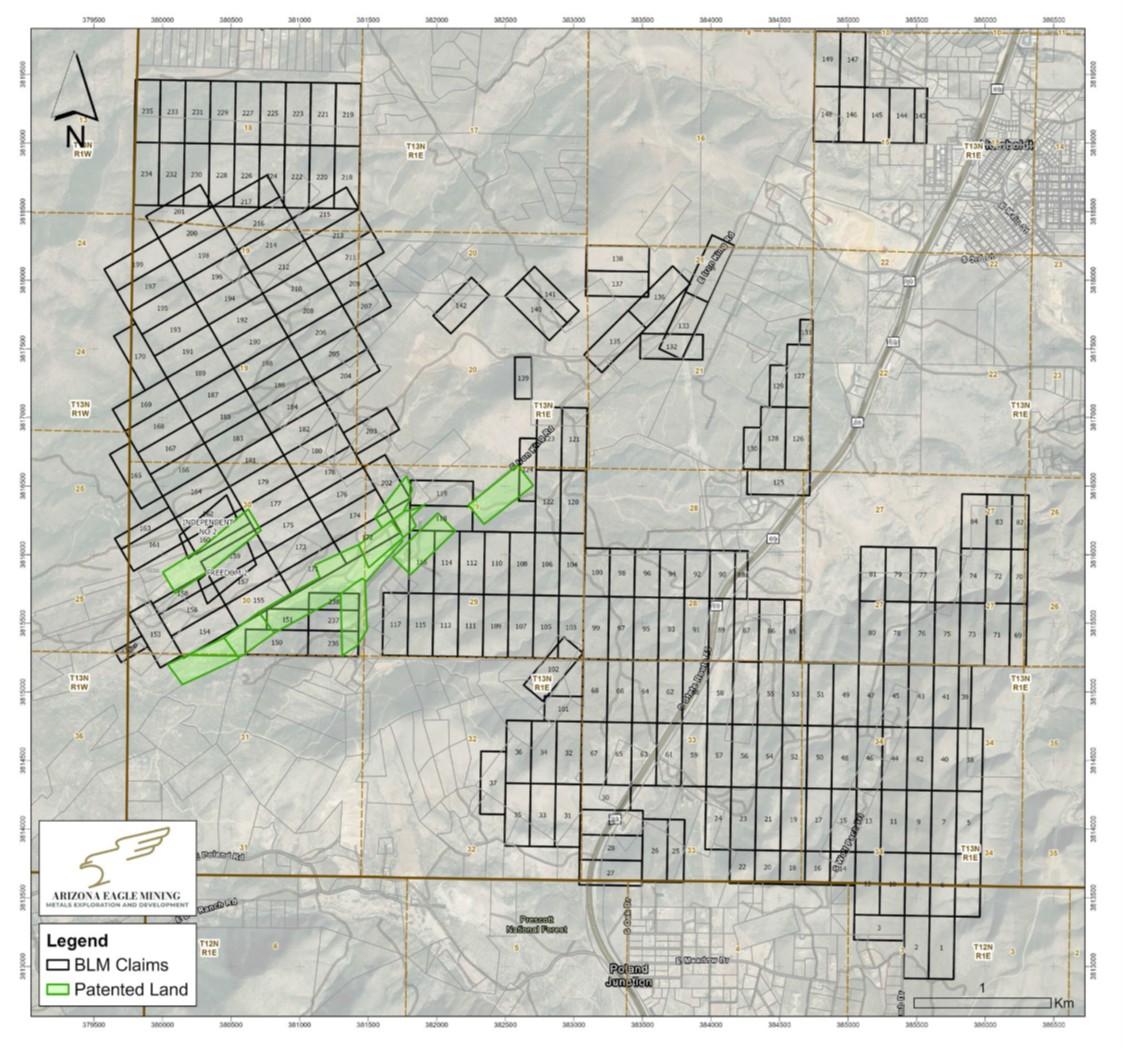

ACG is a private company that owns 100% of the Eagle Project in Yavapai County, Arizona which is located on 239 unpatented BLM mining claims totaling 4,544 acres that are not subject to any royalties, and 203 acres of patented lands. See Figure 1.

News Release November 24, 2025

Figure 1: Eagle Project claims map, location in Arizona.

Historical Exploration and Production of the Eagle Project

The Eagle Project claims host at least 12 past-producing gold mines. The Eagle Project also includes 203 acres of patented mining claims, which host the past-producing McCabe mine. Approximately US$35 million was spent from 1981 to 1986 (~CDN$110 million in 2025 dollars) to define and put the McCabe mine into production. A historic estimate in 19841 calculated total reserves of 877,617 ounces of gold at a grade of 11.7 g/t as well as 5,119,169 ounces of silver at a grade of 69 g/t. (the “Historical Estimate”). Approximately 80,000 ounces of gold were recovered from the mine before its closure in 1987.

Acquisition of Eagle Project by ACG

1 Source: Knight, D.C., 1984, Stan West Mining Corp. McCabe-Iron King Belt project summary and financial information for shareholders. See Caution Regarding Historical Estimate, below.

News Release November 24, 2025

ACG acquired 238 unpatented mining claims through its wholly-owned subsidiary company, Arizona Desert Land Holdings Corp., by staking (April 24–30; May 1–5; June 18) and filing with the Bureau of Land Management on July 17, 2024. These claims cover a total area of 4,543.6 acres (1,838.7 hectares; 18.38 km2). In addition, ACG has acquired, through Arizona Desert Land Holdings Corp., the following patented claims through purchases:

– On February 19, 2025, the company purchased eight patented mining claims from Big Bug Gravel & Gold, LLC, of Elko, NV, totaling approximately 87.44 acres (35.3 hectares; 0.36 km2) in Sections 15–16, 19–21, and 29–32, Township 13 North, Range 1 East, Yavapai County, Arizona. The eight claims include the Gladstone, Gladstone Westerly Extension, Sink to Rise, Monopolist, Little Kicker, Rebel, McCabe, and Columbus claims. The full purchase price was US$2,000,000.00, plus the buyer’s closing costs, plus a 2% NSR to the seller (with the option for ACG to purchase 1% for US$1 million).

– On February 9, 2025, the company purchased three patented mining claims from Charles & Coral J.T. Freeman totaling 31.64 acres in the Big Bug District, Yavapai County, Arizona. The three claims include Palo Alto, Sunol, and Columbia. As part of this agreement, the company also acquired two unpatented mining claims named Independent No. 2 and Freedom 2 totaling approximately 40 acres. The total area acquired is approximately 71.64 acres (29 hectares; 0.29 km2). The full purchase price was US$700,000.00,

– Additional parcels of land were acquired by ACG over the course of 2025 for an aggregate purchase price of $1,465,083 (US$1,000,000). These claims, together with the two acquisitions listed above, are displayed in the “Patented Land” of Figure 1.

Exploration on the Eagle Project by ACG

To ACG’s knowledge, no exploration work had been completed on the Eagle Project by prior owners since the early 1990s. ACG began conducting exploration work on the Eagle Project in 2024, and the sampling program completed by ACG in 2024 identified at least 12 mineralized zones and structures which have not been tested with modern exploration methods (including geophysics or drill testing).

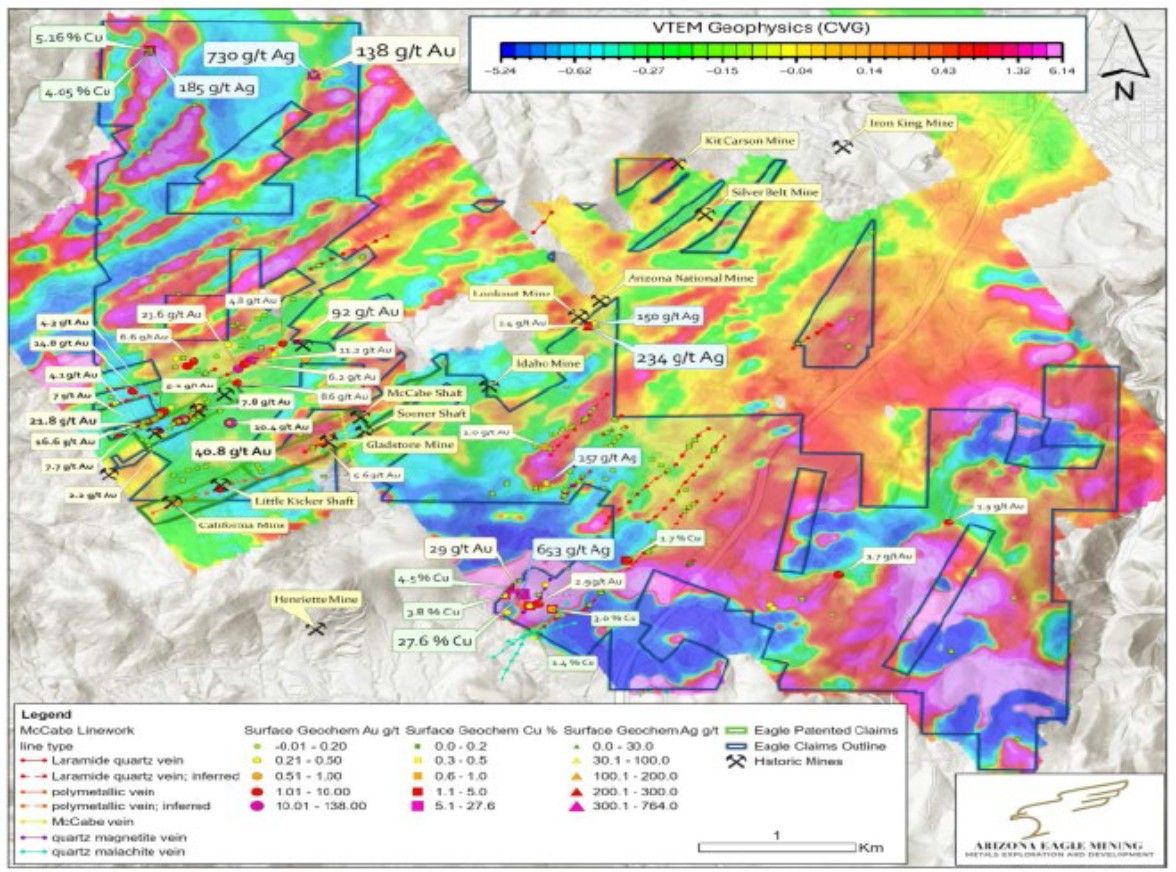

Exploration on the Eagle Project was carried out by Ethos Geological during 2024 and 2025, with a focus on geological mapping and systematic sampling of mineralized outcrops, mine dumps, and historical workings. A total of 312 grab and channel samples were collected and submitted for analysis. Of these, 47 samples returned >1.0 g/t Au (up to 92.0 g/t), 27 samples >50 g/t Ag up to 764 g/t), and 17 samples >0.5% copper (Cu) (up to 27.6%).2

Five NE-striking zones of gold mineralization—collectively termed the Gold Zones—were mapped and sampled across a 2.17 mi (3.5 km) trend. The most notable results include 16 gold assays in the Sunol Extension Zone exceeding 1.0 g/t Au, with peak values of 23.6 and 92.0 g/t Au. Channel samples from quartz veins returned up to 14.8 g/t Au, and mineralized veins were observed to crosscut all rock units, including Cretaceous tonalite, supporting a Laramide-age classification for the McCabe-type vein system.

To the south, a distinct Copper Zone was delineated, with high-grade copper assays up to 27.6% Cu, along with associated anomalous gold (up to 29.4 g/t Au) and silver (up to 653 g/t Ag)2. The copper mineralization is hosted in black, Fe-oxide and copper oxide–stained quartz-magnetite-pyrite-specularite rocks interpreted as exhalites, indicative of VMS-related processes. Additional sampling of Fe-oxide gossans southwest of the Iron King Mine revealed structural features and metal associations consistent with Iron King–style VMS lenses, highlighting the potential for both structurally controlled vein-hosted and stratiform sulfide mineralization across the project area.

2 See ACG press release of February 19th, 2025 for detailed sampling results and methodology: https://www.arizonaeaglemining.com/_resources/news/nr_20250219.pdf

News Release November 24, 2025

An airborne geophysical survey carried out by Geotech Ltd. in April 2025 collected versatile time-domain electromagnetics (VTEM), magnetic, and radiometric data on 50-meters (m) spaced stations on 699-line kilometers over the Project area. See Figure 2.

Figure 2: ACG VTEM survey, February 2025

The strongly anomalous copper, gold, and silver results on samples of this type indicate impressive potential for volcanogenic massive sulphide (“VMS”) mineralization within the area sampled and in surrounding areas. Based on strong similarities with Iron King VMS ore, the Eagle Copper Zone represents a target that requires detailed exploration as a potential similar deposit.

Subject to completion of the Proposed Transaction, the Resulting Issuer intends to commence a diamond core drilling program is recommended to expand the known mineralized zones and test new exploration targets. The proposed program includes drilling 16,800 meters across 56 drill holes, targeting known high grade McCabe Au–Ag vein–type mineralization, as well as new targets identified through mapping and geophysical surveys. The program is designed to test and confirm mineralization reported in historical records, as well as assess broader exploration potential. The drilling program is intended to be supported by geological mapping, geophysical surveys, and geochemical surveys to enhance the overall understanding of the deposit and guide future exploration.

Phase 1 of the proposed drill program is expected to focus on the McCabe–Rebel zone, including 21 holes to a depth of approximately 300 m, totaling 6,300 m. These holes may be arranged along three NE–SW trending segments totaling 2,000 m in length, comprising 990 m within the central historic McCabe– Gladstone–Sooner mine area, 750 m between the McCabe and Rebel areas to the southwest, and 260 m northeast of the McCabe area. ACG expects that the net proceeds from the Concurrent Offerings will be

News Release November 24, 2025

used by the Resulting Issuer to complete phase 1 of the proposed exploration program and for general working capital purposes.

Caution regarding Historical Estimate

The Historical Estimate in respect of the Company’s Eagle Project was prepared internally by prior owners Stan West Mining Co. The source of the Historical Estimate is as follows: Knight, D.C., 1984, Stan West Mining Corp. McCabe-Iron King Belt project summary and financial information for shareholders. The Historical Estimate is not compliant with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), a Qualified Person (as defined in NI 43-101) has not done sufficient work to classify the Historic Estimate as current mineral resources or current mineral reserves, and the Company is not treating the Historical Estimate as current mineral resources or mineral reserves. There is no technical report associated with the Historic Estimate. The Historical Estimate contains categories that are not consistent with current CIM definitions. The Historical Estimate includes “inferred resources” together with “proven”, “probable” and “possible reserves”. Under current standards “total reserves” would be classified as “total resources”, and the Company is interpreting the “total reserves” in the Historical Estimate as a historical estimate of “total resources”. The Company considers the Historical Estimate to be relevant for the proper understanding of the Eagle Project, however significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person for the Historical Estimate to be compliant with NI 43-101 standards and to verify the Historical Estimate as current mineral resources. There can be no certainty, following further evaluation and/or exploration work, that the Historical Estimate can be upgraded or verified as mineral resources or mineral reserves in accordance with NI 43-101.

For more information on ACG, visit https://www.arizonaeaglemining.com.

Non-Arm’s Length Transaction and Shareholder Approval

As of the date hereof, there are 39,868,950 ACG Shares issued and outstanding. The following persons own, control or direct 10% or more of the outstanding ACG Shares on a fully-diluted basis:

| Name | Number of ACG Shares (on a fully-diluted basis) | Percentage of Outstanding ACG Shares (on a fully-diluted basis) |

|---|---|---|

| Paul Reid | 8,500,100 | 20.1% |

| Marc Pais | 8,500,100 | 20.1% |

| Kevin Reid | 7,750,000 | 18.3% |

| 17,000,200 | 58.4% |

Directors and officers of Core Nickel collectively own an aggregate of 18,200,200 ACG Shares. Messrs. Pais and Reid, each directors of Core Nickel, each own 8,500,100 ACG Shares (as noted above), Mr. Tim Dalton, a director of Core Nickel, owns 700,000 ACG Shares (1.7% on a fully-diluted basis), Mr. Michael Pilmer, a director of Core Nickel, owns 300,000 ACG Shares (0.7% on a fully diluted basis) and Mr. Christopher Tate, CEO and a director of Core Nickel, owns 200,000 ACG Shares (0.5% on a fully diluted basis).

Additionally, directors and officers of ACG own and control, collectively, an aggregate of 16,355,500 Core Shares, 8,000,000 Core Warrants and 950,000 Core Options: Mr. Paul Reid is a director of Core Nickel and ACG and owns or controls 8,175,000 Core Shares, 3,000,000 Core Warrants and 475,000 Core Options representing approximately 14.9% of the issued and outstanding Core Shares on an undiluted basis and 19.9% of the Core Shares on a partially-diluted basis. Mr. Marc Pais is a director of Core Nickel and ACG and owns or controls 5,180,500 Core Shares 2,000,000 Core Warrants and 475,000 Core Options representing approximately 9.4% of the issued and outstanding Core Shares on an undiluted basis and 13.3% of the Core Shares on a partially-diluted basis. Mr. Kevin Reid, Chief Executive Officer of ACG, owns or controls 2,000,000 Core Shares and 2,000,000 Core Warrants, representing approximately 3.6% of the issued and outstanding Core Shares on an undiluted basis and 7.0% of the Core Shares on a partially diluted basis. Mr. Rick Vernon, a director of ACG, owns or controls 1,000,000 Core Shares and 1,000,000

News Release November 24, 2025

Core Warrants, representing approximately 1.8% of the issued and outstanding Core Shares on an undiluted basis, and 3.6% of the issued and outstanding Core Shares on a partially-diluted basis. Each of Kevin Reid, Marc Pais and Paul Reid also are promoters, directors or officers, and significant shareholders of ACG. As such, the Proposed Transaction will be considered a Non-Arm’s Length Transaction (within the meaning of TSXV Policy 5.2, and accordingly requisite disclosures will be made and procedures followed, including approval of the Proposed Transaction by a majority of shareholders of Core Nickel (excluding certain Non-Arm’s Length Parties (as defined in TSXV Policy 5.2) to the Proposed Transaction).

Furthermore, given the level of ownership and control by ACG management over Core Shares, the Proposed Transaction may constitute a “related party transaction” as such term is defined by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“), and, if so, the Proposed Transaction must comply with the requirements of MI 61-101. The Company would expect to rely on the exemption from the formal valuation requirement pursuant to subsection 5.5(b) of MI 61-101,

as the Core Shares are not listed on a specified market, as determined in accordance with MI 61-101, however Core Nickel would need to obtain minority shareholder approval for the Proposed Transaction pursuant to section 5.6 of MI 61-101 and TSXV policies.

MI 61-101 and the TSXV policies require Core Nickel to call a shareholder meeting and to prepare a corresponding management information circular or filing statement containing detailed disclosure on the Proposed Transaction (the “Disclosure Document“) in order to obtain shareholder approval. Core Nickel and ACG are actively preparing the Disclosure Document and Core Nickel is planning to hold the Core Nickel shareholder meeting in early 2026 (the “Core Nickel Meeting”). Additionally, Core Nickel will also seek the approval of Core shareholders for the Consolidation, the Name Change, the Continuance and the appointment of the new directors of the Resulting Issuer at the Core Nickel Meeting.

ACG will also be seeking approval for the Arrangement and the Proposed Transaction from holders of 66 2/3% of the issued and outstanding ACG Shares at a special meeting of ACG shareholders to be held in early 2026.

Details with respect to the matters to be approved at the Core Nickel Meeting will be contained in the Disclosure Document to be filed in connection with Core Meeting and which will be available for review on Core Nickel’s SEDAR+ profile at www.sedarplus.ca.

News Release November 24, 2025

Summary of Financial Information

A summary of certain unaudited financial information for ACG, disclosed in accordance with TSXV policies, is included in the table below:

| Arizona Copper and Gold Ltd. | As at December 31, 2024 ($) |

| Cash and cash equivalents | 87 |

| Other Current Assets | 1,129 |

| Non-current Assets | 85,913 |

| Total Assets | 87,129 |

| Current Liabilities | 130,094 |

| Non-current Liabilities | – |

| Total Liabilities | 130,094 |

| Shareholders’ Equity (deficit) | (42,965) |

Proposed Directors and Senior Management Team

Upon completion of the Proposed Transaction, it is anticipated that the board of directors and management of the Resulting Issuer shall consist of the following individuals:

Marc Pais – Director and Chair of the Board

Mr. Pais is a Co-founder, Director and CEO of Arizona Metals Corp. He has a BSc in Geological Engineering (Mineral Exploration) from Queen’s University. He was the founder and former President of Telegraph Gold (listed as Castle Mountain Mining, later acquired by Equinox Gold). Mr. Pais has seven years’ experience as a Mining Analyst, with a focus on precious metals development companies. Co-founder and former CEO of Arizona Metals Corp.

Kevin Reid – President, Chief Executive Officer and Director

Mr. Reid has a BSc. Honours in Geological Sciences from Queen’s University, Kingston, and an MBA in Finance from the Schulich School of Business, Toronto. He has over 20 years of capital markets experience, beginning in the Equity Research department at CIBC World Markets in 2002, and then at both GMP Securities and Maxit Capital as a Managing Partner in the Investment Banking departments. He has acted as the lead advisor on numerous equity, debt and merger and acquisition transactions.

Mike Pilmer – Director and Chair of the Audit Committee

Mr. Pilmer has more than 30 years of experience in banking, media and digital content solutions. He joined the Corporate and Investment Banking Group of TD Bank after earning his MBA from Western University in Ontario, Canada. Mr. Pilmer has held senior positions at Southam Inc., Hollinger Inc., Postmedia Network Canada Corp., The Stronach Group and was President and CEO of LexisNexis Canada. Mr. Pilmer is a proposed director of the Resulting Issuer.

Rick Vernon – Lead Independent Director

Mr. Vernon has 30 years of experience as a mining finance professional. He was previously Managing Director and Head of Investment Banking at PI Financial Corp. He was also previously a member of the Board of Directors of Arizona Metals Corp . He holds a BSc in Geological Sciences from Queen’s University, as well as an MBA from the University of Southern California.

Dawn Meidinger – Director

Ms. Meidinger joined the law firm of Dorsey & Whitney LLP as a Regulatory Affairs partner in 2024. She has multidisciplinary experience permitting mining, linear and renewable energy projects and managing all aspects of necessary federal approvals (including NEPA, NHPA, and ESA processes) while working with various federal and state agencies, including the Bureau of Land Management, U.S. Forest Service and

News Release November 24, 2025

Arizona State Land Department. Ms. Meidinger also has significant experience in project development on public lands. She has acted as lead counsel on significant BLM land exchanges and state land purchases and the permitting of numerous exploration and mine plans of operation and solar projects in Arizona and New Mexico.

She has been recognized by Best Lawyers in America® for expertise in Energy Law, Environmental Law, Natural Resources Law and Mining Law (2016-2024) and been ranked by Chambers USA for the past seven years as a leading environmental lawyer.. She received her J.D. from Arizona State University, Sandra Day O’Connor College of Law, and her B.S. from Arizona State University.

Eric (Sung Min) Myung – Chief Financial Officer

Mr. Myung was a senior financial analyst at Marrelli Support Services Inc. He previously worked at public accounting firms for 7 years. Mr. Myung possesses a Canadian Professional Accountant designation and a Master of Accounting degree from University of Waterloo. Mr. Myung currently serves as Chief Financial Officer of Abitibi Metals Corp., Sokoman Minerals Corp., Arizona Metals Corp., Mogotes Metals Inc. City View Green Holdings Inc., Labrador Gold Inc. and Melkior Resources Inc.

Clyde Smith QP– Vice President, Exploration

Mr. Smith is a veteran exploration geologist with 40+ years of experience and four deposit discoveries. He founded the Ogilvie Joint Venture in 1974, discovering the Jason lead-zinc-silver deposit in Yukon (later sold to HudBay Minerals). As co-founder of Ventures West Minerals and VP Exploration at Westley Mines, he discovered the Santa Fe gold deposit in Nevada—the first significant Carlin-type gold find in the region—

containing 400,000+ oz and later sold to Corona Corporation, which began production in 1988. Sponsorship of the Proposed Transaction

Pursuant to Policy 2.2 of the TSXV, sponsorship is required in a Reverse Takeover (as defined in the policies of the TSXV). The Resulting Issuer intends, subject to the approval of the TSXV, to rely on an exemption of the sponsorship requirements provided in section 3.4(a)(i) of TSXV Policy 2.2. Management of the Resulting Issuer meets the standards contemplated in section 3.4(a) of TSXV Policy 2.2. In addition, the Resulting Issuer will be a mining company that satisfies the Tier 2 initial listing requirements as provided in TSXV Policy 2.1 and the Eagle Project property of the Resulting Issuer has a current geological report.

Qualified Persons

The technical information in respect of ACG in this news release was prepared under the supervision of Clyde L. Smith, PhD. Mr. Smith is a Qualified Person for the purposes of NI 43-101 and has reviewed and approved the technical information disclosed in this news release. Mr. Smith is non-independent of ACG.

Quality Assurance and Quality Control (QA/QC)

Rock samples consisting of grab and channel samples from mineralized outcrops, float, and historical mine dumps were collected by Ethos Geological personnel on behalf of ACG Sample locations were recorded using handheld GPS units. Quality control samples were inserted into the sample stream at regular intervals, including certified reference materials (standards) and blank samples at a frequency of approximately 5% (one quality control sample per twenty field samples).

Samples were transported directly to ALS USA Inc. laboratory in Tucson, Arizona by Ethos Geological personnel. Chain-of-custody documentation was maintained from collection through analysis. No sample losses or discrepancies were reported. ALS USA Inc. is an independent commercial laboratory with ISO/IEC 17025 accreditation and no financial relationship to ACG. Sample preparation followed method Prep-31Y. Two analytical methods were applied: Gold Analysis (Au-AA23), with samples exceeding 10 g/t Au were re-analyzed using gravimetric finish; and Multi-Element Analysis (ME-MS61), with samples with base metal concentrations exceeding upper detection limits analyzed using ore-grade methods (ME OG62).

News Release November 24, 2025

Nine certified reference material (CRM) samples and eight blank samples were submitted with the 312 field samples. All standard results fell within acceptable limits and all blank samples reported below detection limits for gold, silver, copper, lead and zinc.

Review of ALS internal quality control certificates confirmed that all analytical batches met laboratory quality control standards. No batches required re-analysis. Assay certificates are available for all samples submitted.

Further Information

ACG and Core Nickel will provide further details in respect of the Proposed Transaction and the Concurrent Offerings (including closing of the Concurrent Offerings) in due course by way of a subsequent news release, however, Core Nickel will make available to the TSXV, all information, including financial information, as may be requested or required by the TSXV.

All information contained in this news release with respect to Core Nickel and ACG was supplied by the respective party, for inclusion herein, without independent review by the other party, and each party and its directors and officers have relied on the other party for any information concerning the other party.

For further information on Arizona, please contact:

Arizona Copper and Gold Ltd.

Kevin Reid

Chief Executive Officer

Email: [email protected]

For further information on Core Nickel, please contact:

Core Nickel Corp.

Christopher Tate, President and CEO

Tel: 647-403-3797

Email: [email protected]

Also find Core Nickel online:

Cautionary Statement

This news release contains forward-looking statements and forward-looking information (collectively, “forward- looking statements”) within the meaning of applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “will”, “estimates”, “believes”, “intends” “expects” and similar expressions which are intended to identify forward-looking statements. More particularly and without limitation, this news release contains forward-looking statements, including statements concerning the Proposed Transaction (including the Name Change, Consolidation and Continuance), the Concurrent Offerings, the requisite approval of Core Nickel shareholders and ACG shareholders, court approval of the Arrangement, the proposed Definitive Agreement, and the proposed structure by which the Proposed Transaction is to be completed. Forward

looking statements are inherently uncertain, and the actual performance may be affected by a number of material factors, assumptions and expectations, many of which are beyond the control of the parties, including expectations and assumptions concerning (i) the Company, Core Nickel, the Resulting Issuer, and the Proposed Transaction, (ii) the ability of the parties to negotiate and enter into the proposed Definitive Agreement on satisfactory terms as proposed, (iii) the timely receipt of all required shareholder, court and regulatory approvals (as applicable), including the approval of the TSXV, (iv) if the proposed Definitive Agreement is entered into, the satisfaction of other closing conditions in accordance with the terms of the proposed Definitive Agreement, (v) the ability of the parties (as applicable) to complete the Concurrent Offerings and/or the Proposed Transaction on the terms outlined in this news release (or at all),

News Release November 24, 2025

and (vi) if the Proposed Transaction is completed, the ability of the Resulting Issuer to execute on the proposed exploration program at the Eagle Project. Readers are cautioned that assumptions used in the preparation of any forward- looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties and other factors, many of which are beyond the control of the parties. Readers are further cautioned not to place undue reliance on any forward-looking statements, as such information, although considered reasonable by the respective management of the parties at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

The forward-looking statements contained in this news release are made as of the date of this news release, and are expressly qualified by the foregoing cautionary statement. Except as expressly required by securities law, neither Party undertakes any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise.

Completion of the Proposed Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable pursuant to the requirements of the TSXV and disinterested shareholder approval. Where applicable, the Proposed Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Proposed Transaction, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Core Nickel or ACG should be considered highly speculative.

The TSXV has in no way passed upon the merits of the Proposed Transaction and has neither approved nor disapproved the contents of this news release.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

This news release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the United States or in any other jurisdiction, nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the U.S. Securities Act, or any state securities laws, and accordingly, may not be offered or sold in the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.