SHAREHOLDER MESSAGE – FEBRUARY 2026

Dear Core Nickel Shareholders,

We are excited to share a significant milestone in our corporate journey: Arizona Eagle Mining has received conditional approval from the TSX Venture Exchange (“TSX-V”) to list its common shares under the trading symbol “AZEM.” This approval marks a pivotal step toward the completion of the proposed Reverse Takeover (“RTO”) transaction between Core Nickel Corp. and Arizona Copper and Gold Inc., which will result in the formation of Arizona Eagle Mining. Upon closing, the new entity will focus on advancing high-potential mineral exploration projects, with an immediate emphasis on the Eagle Project in Arizona.

Eagle Project Overview

Arizona Copper and Gold owns 100% of the Eagle Project, located in mining-friendly Yavapai County, Arizona. The Project is anchored on the past-producing McCabe Mine, located on over 300 acres of private land. More than US$35M (over C$110M in today’s dollars) was spent by Stan West Mining to drill and develop the mine. In 1984, Stan West Mining published a historic resource estimate (non NI 43-101 compliant) of 878,000 ounces of gold at 11.7g/t and 5 million ounces of silver at 69 g/t. This estimate was calculated at a gold price of only $360/oz. Between 1986 and 1987, approximately 60,000 ounces of gold were mined from the deposit, before shutting down due to falling gold prices. The bulk of the deposit remains untouched and is open for expansion in all directions.

Figure 1: Long section showing 1984 Stan West Mining historic estimate of 878,000 ounces of gold at 1.7 g/t with 5 million ounces of silver at 69 g/t. Defined to a maximum depth of only 440m and open in all directions for expansion.

Over the last two years, Arizona Copper and Gold has acquired and staked additional claims around the McCabe Mine totaling almost 4,500 acres. It has also completed extensive mapping, sampling, helicopter VTEM surveys, and ground-loop IP surveys. This is the first modern exploration on the property in 40 years and has identified numerous structures parallel to McCabe that were not historically drill tested. Many of these structures host small past-producing mines; sampling of the structures has returned very high grades of gold, silver and copper.

Figure 2. Plan map showing Arizona Eagle’s patented (private) claims of 300 acres and BLM claims of 4,250 acres. Multiple structures parallel

to the McCabe Mine have been identified and sampled, with many returning very high grades of gold, silver, and copper.

Overview of the Transaction

The RTO will combine Core Nickel’s public listing platform with Arizona Copper and Gold’s promising assets, creating Arizona Eagle Mining as a dynamic exploration company. This strategic merger positions us to unlock value through targeted drilling, land expansion, and geophysical surveys at the historic McCabe deposit, a key component of the Eagle Project. The transaction is designed to enhance shareholder value by providing access to a robust exploration program and increased market visibility.

Exciting Developments at the Eagle Project

Drawing from recent updates provided to Arizona Copper and Gold shareholders, we highlight the tangible progress already underway:

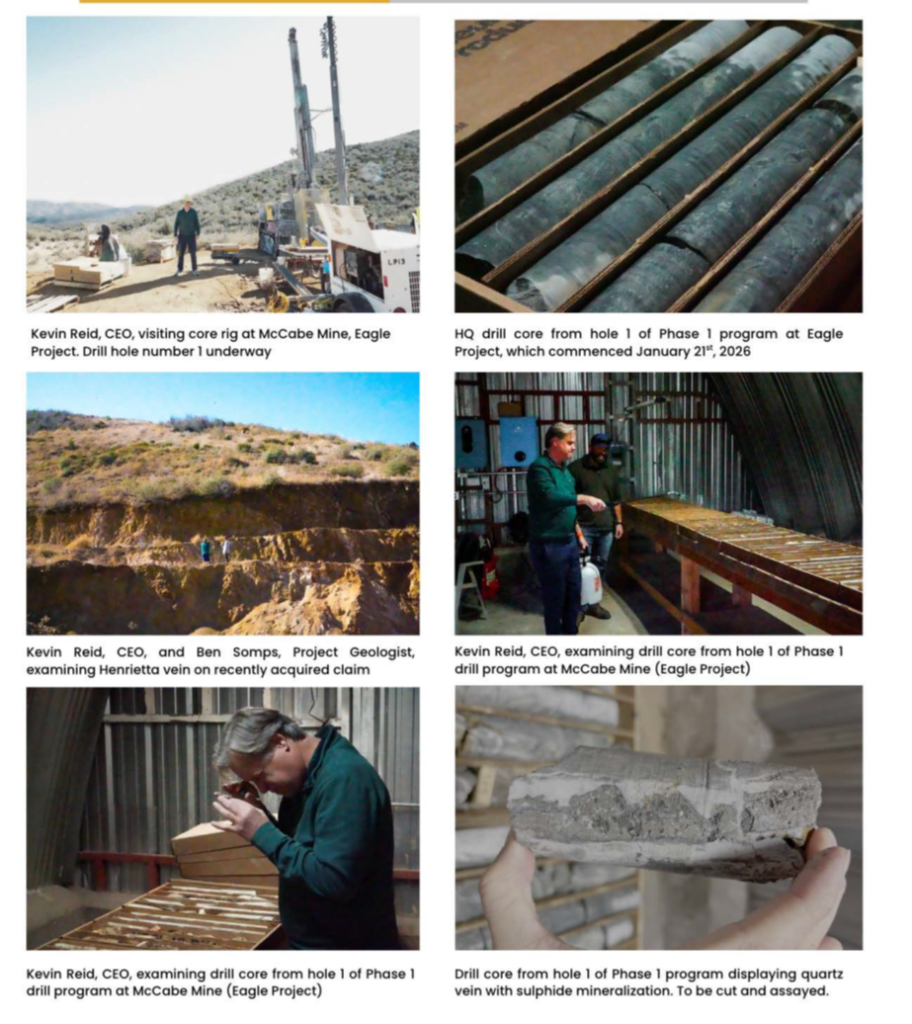

- Drilling Program: Drilling commenced on January 21, 2026, with an initial 4,500 meters of HQ-diameter core drilling aimed at testing mineralization below the historic McCabe Mine workings. This phase is evaluating the deposit’s expansion potential, with plans to extend the program along strike and to parallel structures once the RTO transaction has been approved by shareholders. Early site visits by Arizona Eagle’s leadership, including Chairman Marc Pais and CEO Kevin Reid, confirm smooth operations, and initial drill core shows promising quartz veins with sulphide mineralization. Upon completion of the RTO, Arizona Eagle will be fully-funded to compete the Phase 1 drill program.

- Land Expansion and Exploration: The project’s patented land position has grown from 120 acres to more than 300 acres in recent months, strengthening control over prospective ground. A surface sampling program was initiated in February 2026 to identify additional targets, complemented by an induced polarization (IP) geophysical survey completed in December. Results from the IP survey are being interpreted to guide future drilling, ensuring a data-driven approach to exploration.

- Timely Results and Listing Alignment: First drill results from the McCabe program are expected around the time of our anticipated approval of the RTO transaction, providing fresh data to support the company’s debut and attract investor interest.

These activities demonstrate the project’s momentum and the team’s commitment to efficient advancement and strategic growth. By merging with Arizona Copper and Gold, Core Nickel shareholders will gain exposure to this active exploration pipeline, which is poised for value creation through disciplined resource development.

Corporate Marketing and Visibility

To ensure a strong market entry, Arizona Eagle Mining has secured marketing partnerships with leading industry platforms, including Kitco.com, CEO.ca, The Northern Miner, InvestorIdeas, and Resource World Magazine. CEO interviews have been filmed and are scheduled for release, alongside a 30-second overview video to be broadcast on BNN for three months starting from the listing date. These initiatives will broaden awareness of the project, team and opportunities, helping to drive liquidity and investor engagement.

Vote in Favour at the March 13th Shareholder Meeting

The upcoming shareholder meeting on March 13, 2026, is your opportunity to shape the future of our Company. Shareholders can expect to receive voting materials in the mail in the next few weeks. We strongly urge you to vote in favour of the RTO transaction. This merger represents a transformative step that aligns Core Nickel’s strengths with Arizona Copper and Gold’s high-quality assets, creating a well-funded entity ready to capitalize on the Eagle Project’s potential. By approving the transaction, you will help position Arizona Eagle Mining for success in a favorable market environment, with immediate exploration results and enhanced visibility on the horizon. More information on the upcoming shareholder meeting can be found on our website.

The conditional TSX-V approval underscores the transaction’s viability and the Exchange’s confidence in our path forward. Your support is crucial to realizing this vision—failure to approve could delay or jeopardize these opportunities. We encourage you to review the meeting materials carefully and cast your vote promptly. If you have any questions, please contact Chris Tate, CEO, at the email address below.

We appreciate your continued trust and investment in Core Nickel. Together, we can transition to Arizona Eagle Mining and pursue the next chapter of growth and discovery.

Sincerely,

Chris Tate

CEO & President

Core Nickel Corp.